Zambia: The Idea of a Kwacha

The movements matter, but perhaps they shouldn’t.

Preface

A currency is synthetic. Curious, isn’t it? Something that doesn’t exist… and yet carries weight. Currencies allow you to read this. Ancient ideas, old kingdoms… but the origin barely matters. The reason is what fascinates us.

Humans have walked the earth for millennia. Why, then, are currencies so recent? Who created them? Why? Can you see it? Can you feel it? Who imagined such a living, breathing concept? Divine intervention? Chance? Or… sheer curiosity?

It is environment. It is necessity. Growing collective identities demanded a way to cohabitate. How... boring.

Currencies are language. Say “one million dollars,” and we know what it is means.

One million buckackaroos????

A currency is not a product of value. It is a way to say: I am better than you.

Are you serious?

Let's observe.

The Esoterics of Economies

Maybe... David Ricardo was right all along, you can see it woven in the Fibonacci spirals, as if the currency moves by some secret natural law, laughing at human models. Take a look at this:

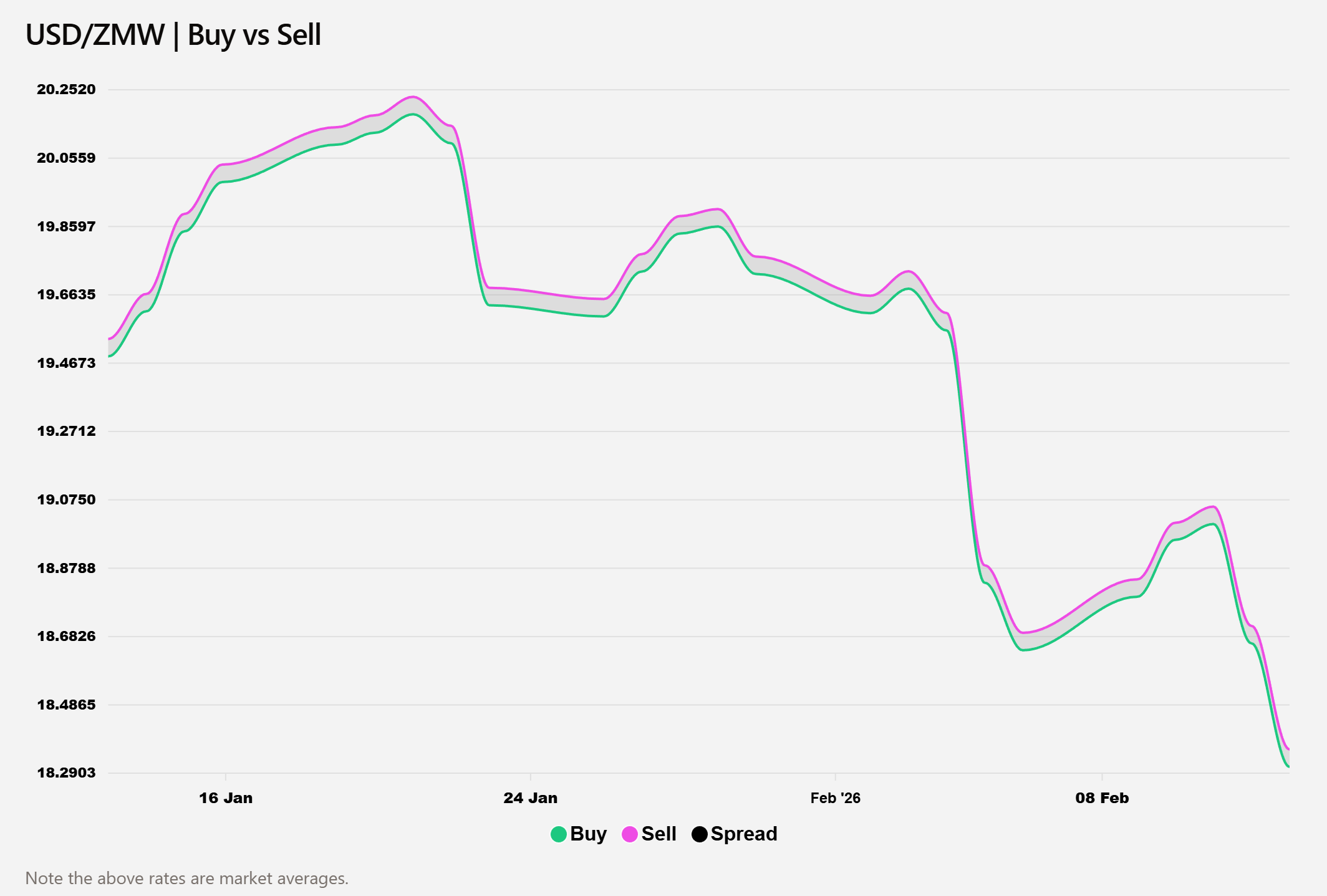

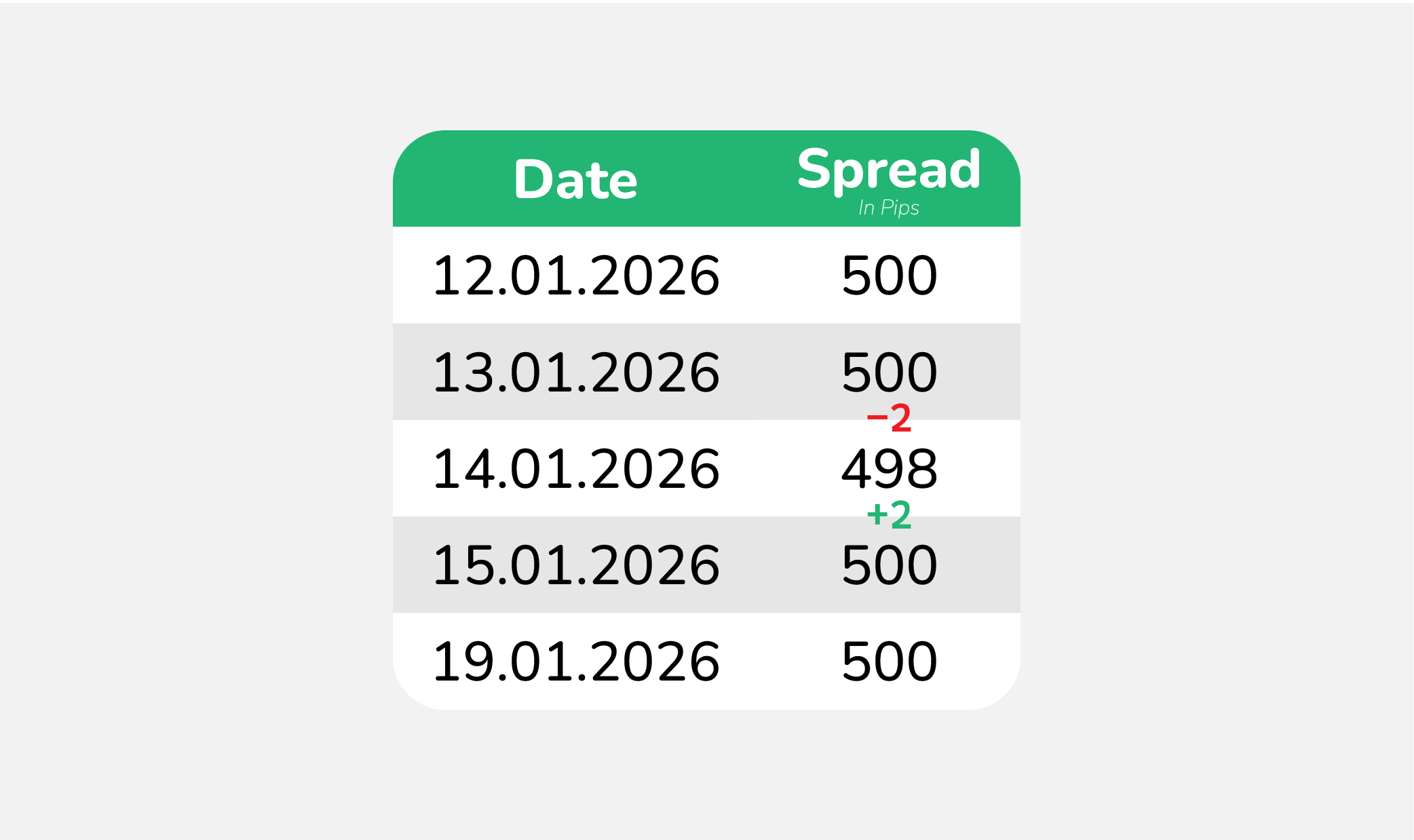

Indeed, the Zambian Kwacha (ZMW) outlook has been appreciating against the USD, YTD as of writing is 16.38%. Wait a second, 16.38% appreciation against a global currency in half a quarter... now that is very... intriguing. A number too precise for coincidence, too rapid for reason. The spread has constantly been 500 pips, not shocking for the natures of the currencies (non-competing), however, money markets are free markets... right?

This, reader, is what David Ricardo and other neoclassical economists argued into eternity:

Markets are self-correcting

But I only ask you to ponder, reader, is the spread stubborn, or is the market merely pretending to be free?

La Lingua Franca

Neoclassicists were indeed correct, but only on the surface. Once viewed from a point of abstraction, we can see what they could not.

The spread is the difference between a currency pair's ask and bid, we will measure it in pips. A pip in our context equals 0.0001 of value; Therefore a larger spread infers that higher entry cost, lower margins, and unfavorable exit conditions. Let us take a deeper look:

Ah yes, as clear as day. The spread never changes. Free market economics hinges on volatility, money markets are free markets, or so we're told. The spread drops two pips on the 14th of January 2026, who dared try to prove that they are better? How fascinating!

Yes the Kwacha appreciated massively against the USD before Q1 2026 is even over, however, that is not the intrigue here. The spread, never changes. Wouldn't an economy in prosperity attempt to say "I am better than you"?

This, reader, is the ever so mystical, hidden hand.

Named by Neoclassicists who saw something, but where is it? Perhaps... it exists nowhere at all, and everywhere.

The Collective Unconscious

Carl Jung said said that the collective unconscious is considered the foundation of the human psyche; Such as birth, death, and power.

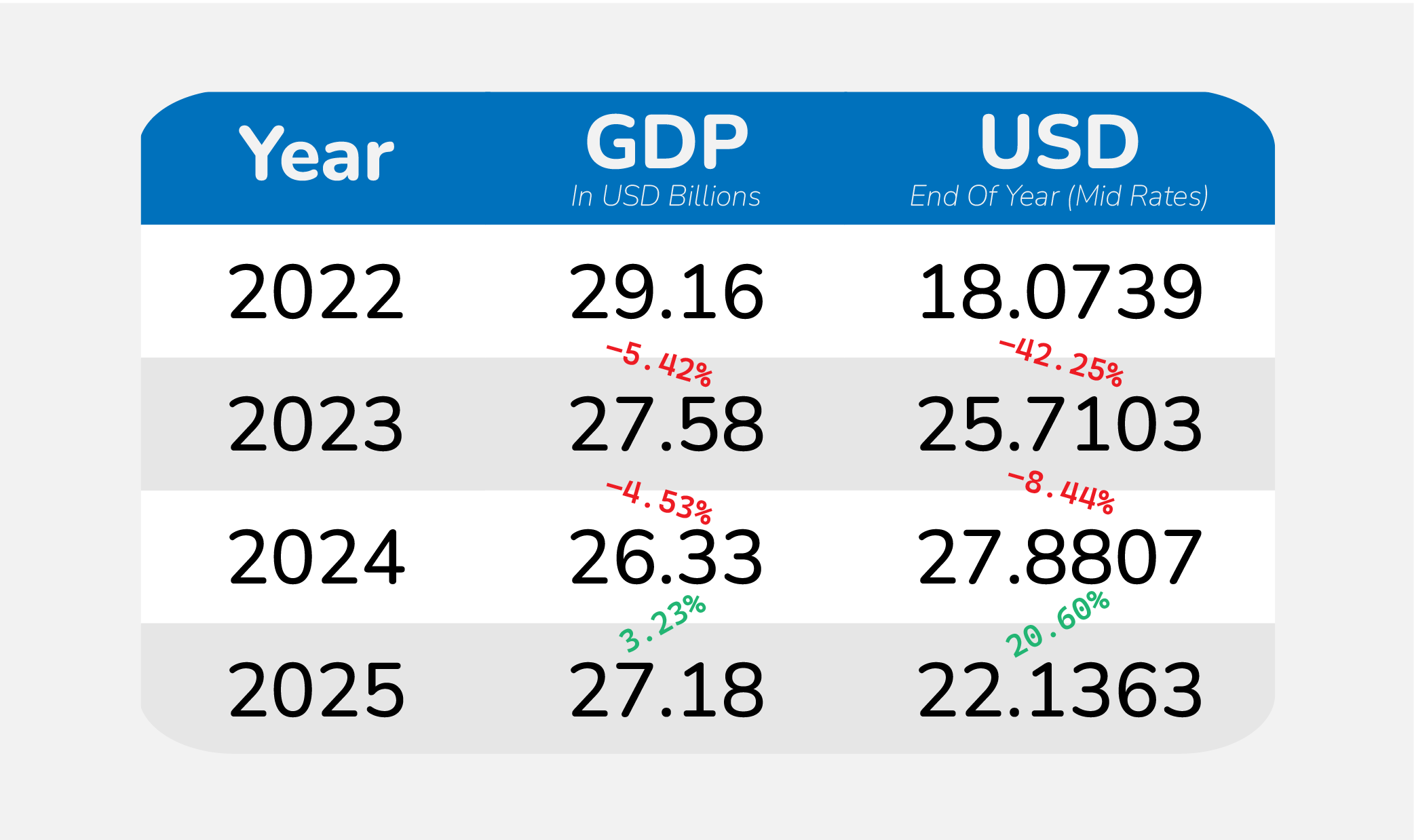

Zambia has been in a years long, and convoluted, debt restructuring process. That is a topic of it's own, however, let's observe the following:

The International Monetary Fund (IMF) is an international financial institution.

The IMF states to have three critical missions (verbatim): furthering international monetary cooperation, encouraging the expansion of trade and economic growth, and discouraging policies that would harm prosperity.

Zambia has an IMF Extended Credit Facility (ECF) program that’s been extended and continues to support macroeconomic targets. Therefore, the IMF remains central in Zambia's debt restructuring.

Well... the IMF transacts and settles primarily in... USD. Do you see it now? The IMF possesses enough currency to say that "I am better than you". How could a currency and economy in prosperity not let the spread be free. Look at this:

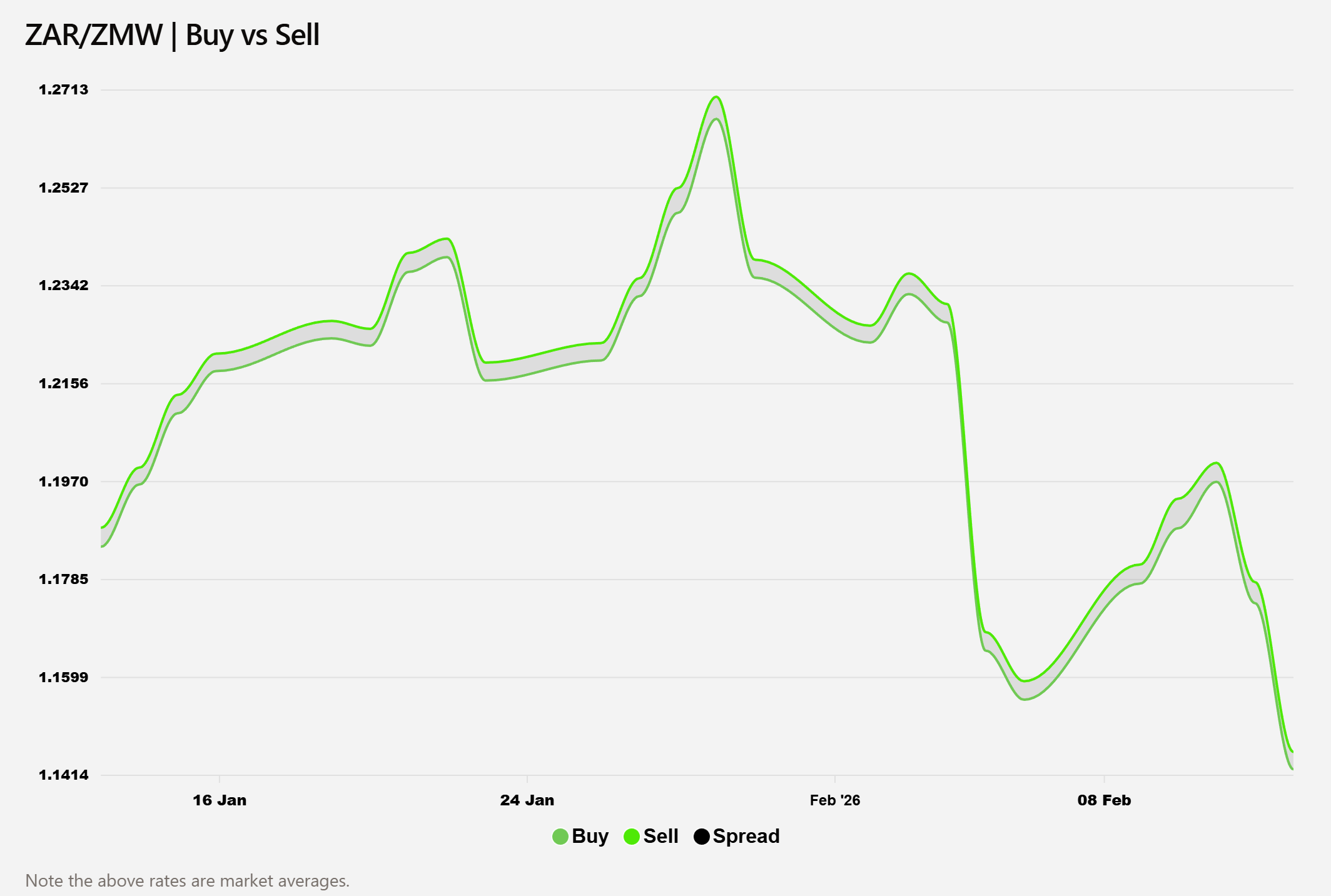

How brilliant, look at the spread between the South African Rand (ZAR) and ZMW. These are not global economies, but local competing economies. They are both trying to say "I am better than you". You can see it. Look at the volatility, range 31 pips between 32 and 67 pips. Let me restate, that is 1400% more volatility than the spread between the USD and ZMW. This, is a free market economy.

We can therefore infer, reader, that regardless of the perceived prosperity of the ZMW against the USD, currency is the real lingua franca.

The IMF controls global currency.

Most transactions occur in USD.

Therefore… the USD is the lingua franca. And this, reader, it silently says, "you are not better". And we all, collectively, understand.

One million buckaroos???

We all know what that means.

And accordingly so, the USD/ZMW spread is effectively constant, unquestioned, like the unconscious itself. The USD says that you are not better than it, and we all collectively have that concept, like Jung once said.

Terra Firma

Take look at the signals below:

This has Keynes written all over it. It is as if we're in our first "intro to macroeconomics" class, right? Note below:

Zambians, the collective that gives the Kwacha its power, thought they heard the USD say, “You’re doing well.” You can see it.

Zambia's economy is very agriculture and raw material heavy.

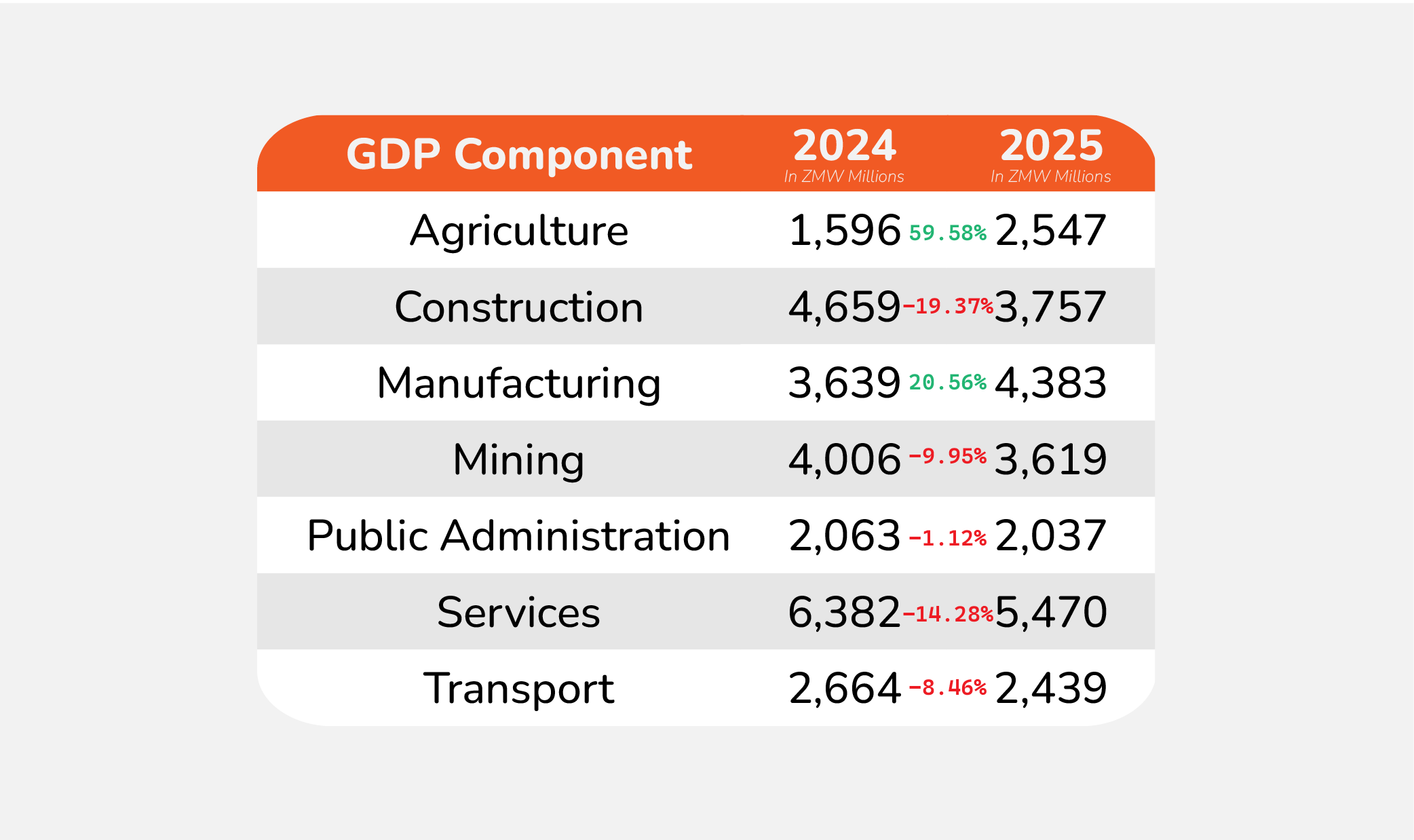

The currency appears to appreciate against an effective giant. Capital flows outward; 14.28% from Services, nearly 20% from Construction, into Agriculture and Manufacturing.

Now that “I am better,” resources return to their supposed strengths: fertile land, copper, soil.

Free trade rewards division of labor, does it not? Why construct stability through property? Why expand services? When strength lies in soil and ore?

This perceived prosperity is, beneath it all, currencies personified. Giants speaking to one another. For now, they are quiet. Let us not forget what happens when they are not.

And there we have it, reader, terra firma. The idea of a kwacha; A stand-in for any currency. Or in other words, language.

Silent, and absolute.

We speak it without knowing. We hear it without noticing.

How... absurd.

For now, we observe. Yet, what becomes of us when the language shifts?