Zambia: The Synthetic Economy

What does it look like when markets disobey textbooks? Apparently, pretty obvious. Let's observe.

Preface

An economy, as described in textbooks, is often portrayed as an intricate yet elegant system, one governed by rational actors, predictable incentives, and self-correcting forces. Inflation rises, interest rates follow. Currencies respond to trade flows. Yields reflect fiscal risk. Lending and deposit rates adjust symmetrically. And at the center of it all is the idea of signal fidelity: that market signals reflect underlying truths.

But in the real world economies are not always honest. They can be dressed, softened, or even manipulated to project stability, confidence, and control. Market signals become distorted; Interest rate movements defy conventional logic. Disinflation appears out of sync with lending behavior. FX stabilizes without the support of a strong export surge or monetary tightening.

We begin at that point of dissonance where the classroom ends and the real economy begins. It questions the integrity of observed economic trends and whether what appears to be recovery is in fact recovery, or merely the illusion of it. And it places this inquiry within the broader intellectual tradition that assumes markets are honest, while reality proves they are often anything but.

The Anatomy of an Economic Illusion

In theory, macroeconomic variables respond to fundamental drivers with observable consistency. When inflation decelerates, central banks are expected to ease; Interest rates decline, bond yields soften, currencies stabilize, and money becomes cheaper. The coherence of these mechanisms underpins orthodox economic models and monetary policy frameworks taught in universities and consequently practiced globally.

Yet, when the signals begin to decouple such as inflation falling but credit tightening, or when bond yields dip but lending rates rise, and when the local currency mysteriously strengthens amid sluggish fundamentals, one must ask if this is this the enigmatic invisible hand, or a hidden one?

We’ll investigate such a divergence currently unfolding in Zambia. The year under review (HY 2025) has seen a conspicuous drop in YoY inflation, consistently reducing treasury yields, and a strengthening and stabilizing foreign exchange rate; All signs, at first glance, of economic recovery. However, once one digs deeper, the monetary transmission mechanism appears to be asymmetric. Lending rates have continued to rise, despite disinflation and easing bond yields, while deposit rates remain well-nigh unchanging. These incongruities defy standard economic logic and hint at deeper, possibly deliberate, distortions.

Disinflation • All of a Sudden?

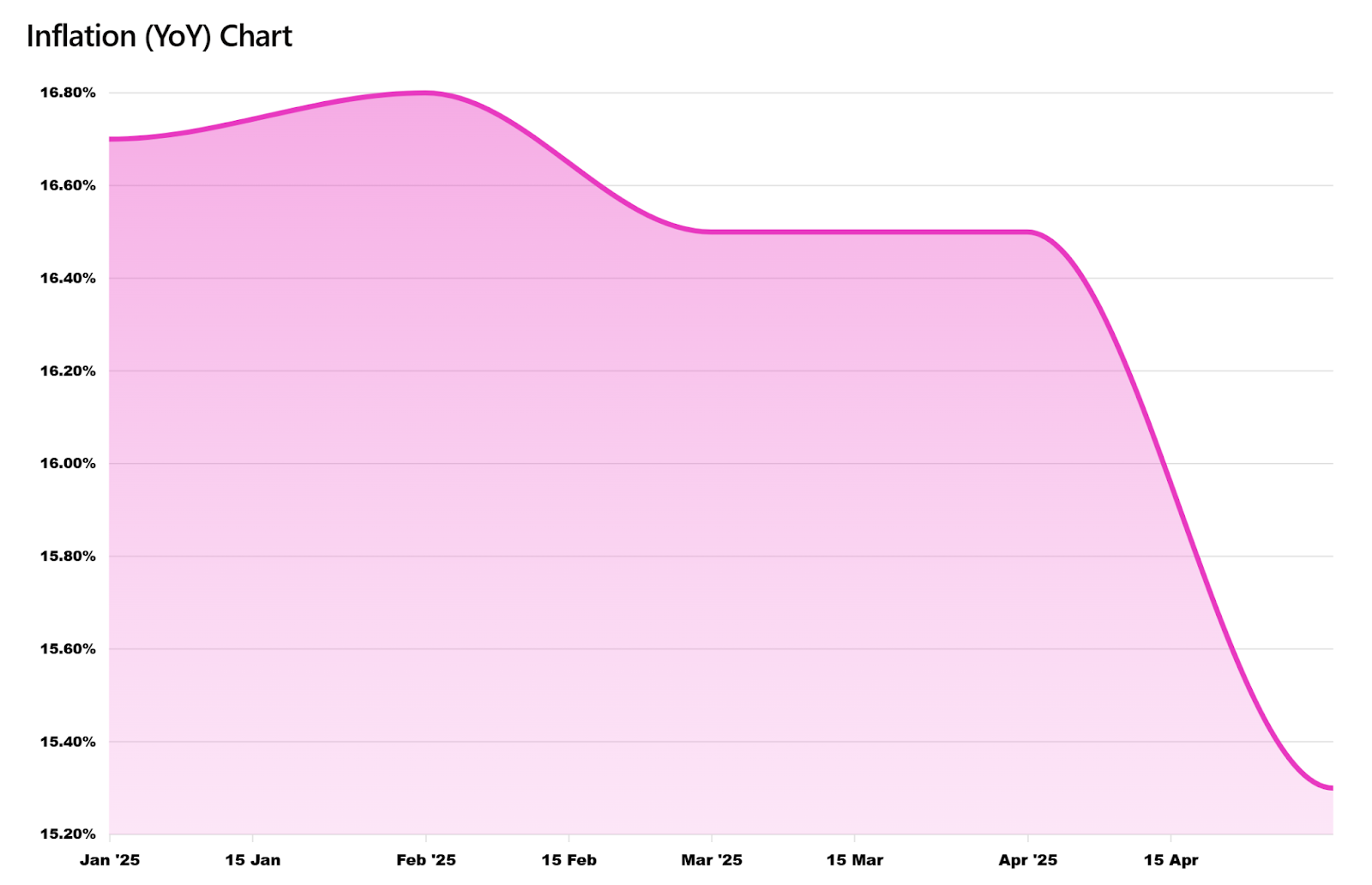

2025 began with the economy still showing signs of inflation as the YoY inflation rate increased by 0.10% from January 2025 to February 2025 to plateau at 16.80%, recovered and stagnated to 16.50% between March and April, and the miraculously entered into a disinflationary trend in May to close at 15.30%. As can be seen below in fig. 1, this drop in inflation is a large magnitude compared to prior changes and seemed to come out of thin air, depicting an image of an economy that is recovering from crises such as a long lasting drought, and a still on-going energy crisis.

On the surface, this looks promising, and garners trust and confidence in the country’s economy. But, is this the actual case? This results in Zambia having a YTD disinflation of 1.40% over 5 months which is meaningful, and significant in the context of prior YoY inflation increments of lesser magnitudes.

Reducing Bond Yields

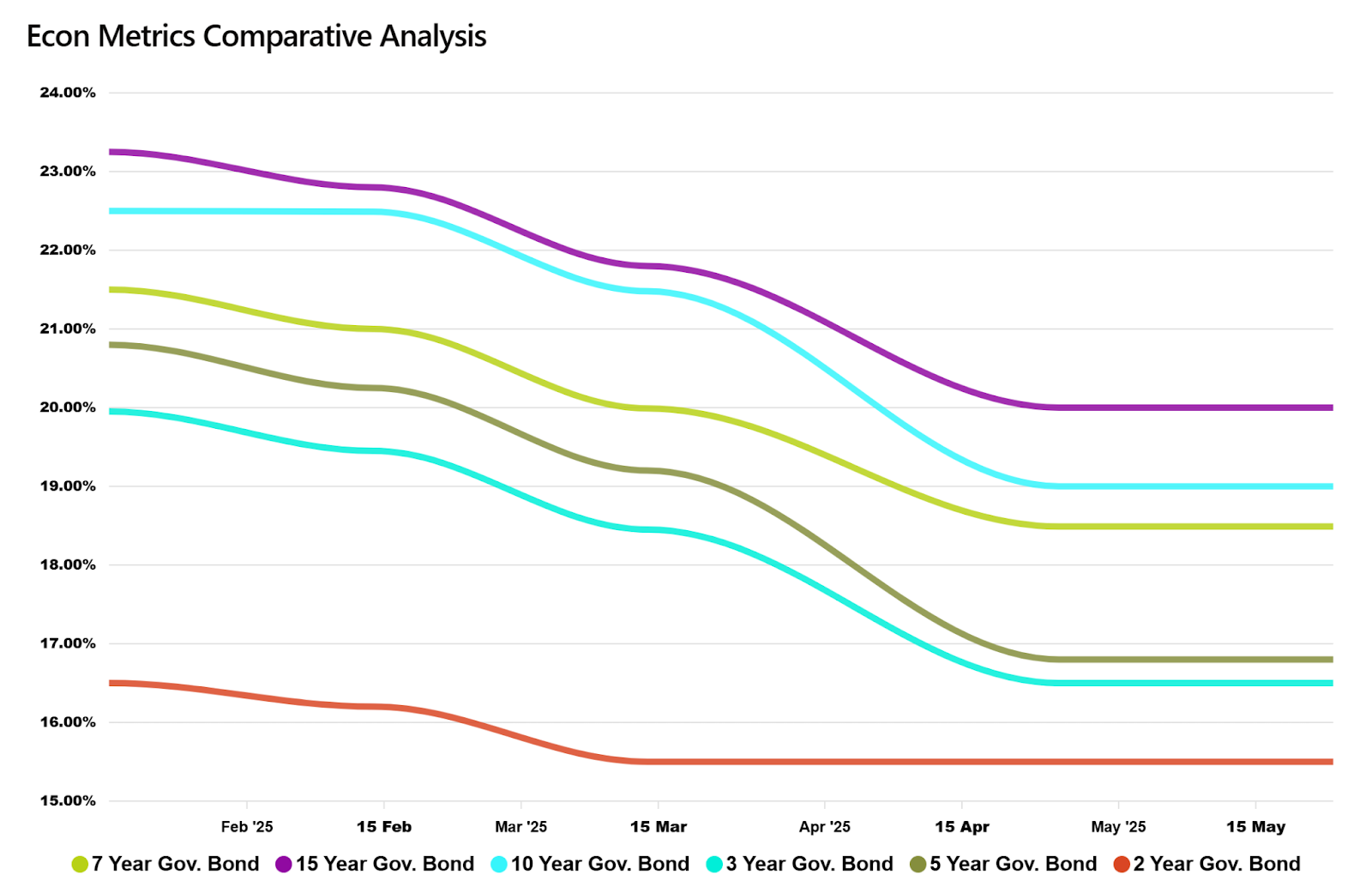

Since the beginning of 2025, GRZ (Government of Zambia) bond yields have been steadily reducing with each tender; This is in line with our prior analysis on the disinflation trend as we would expect a recovering economy to offer lower yields signaling stability and lower risk in an economy. This trend can be seen below in fig. 2.

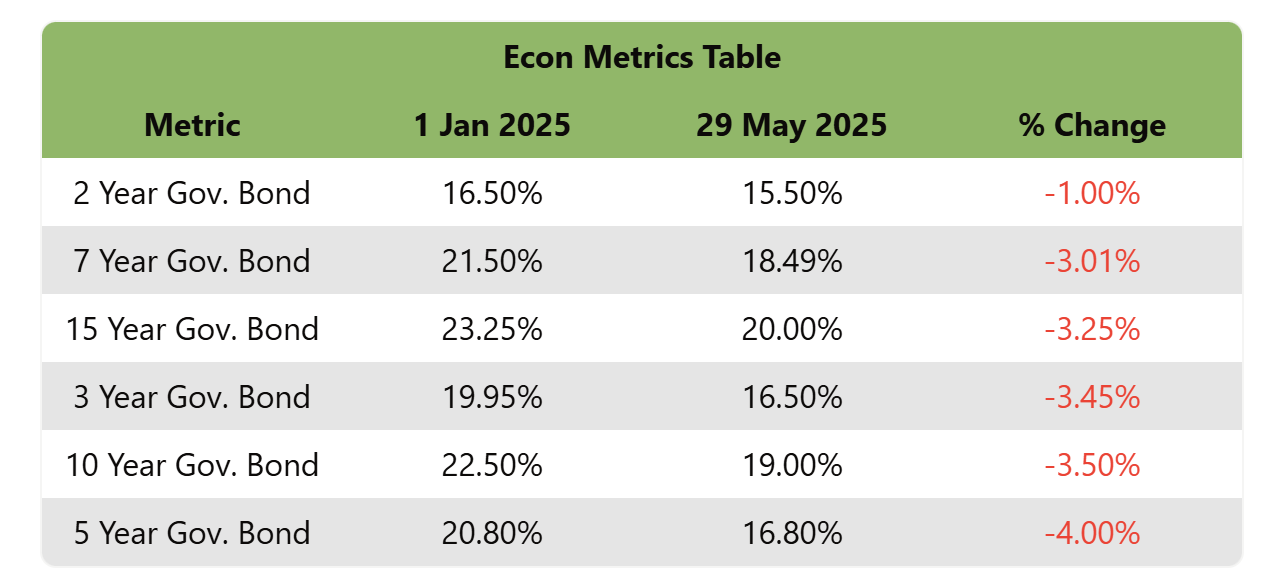

As can be seen, each new tender slightly reduced the yield on all government bonds compared to the previous tender, with most staying stagnant after the aforementioned peculiar disinflation recording. Interesting enough, the magnitudes of these reductions on a YTD basis, save for the 2 year government bond, were all within 3.00% - 4.00%. The drops seem to be in line with future disinflation confidence, however, the similar yield reductions suggest something unnatural such as set ceilings and floors rather than natural price discovery. The exact changes can be seen in fig. 3.

These magnitudes are, for a lack of better words, massive for an economy with YoY inflation at 15.30%; An aggressive and dare I say desperate strategy to raise government funding. What could be causing this increased supply of government debt securities? Could this be a "Hail Mary" attempt to try and ease the effects of the drought and energy crisis. But why now? When these have been ongoing concerns for years.

Kwacha Appreciation

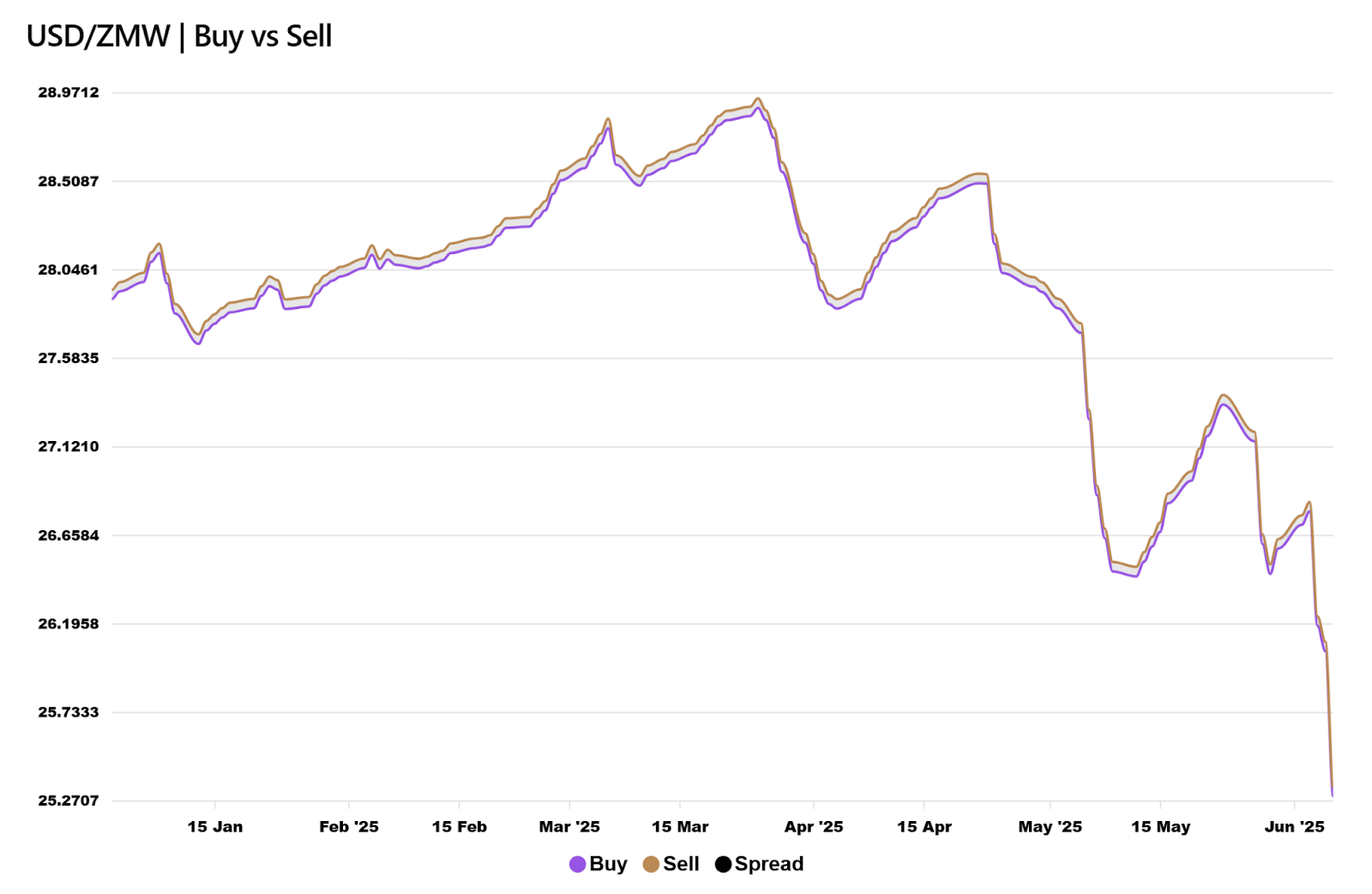

The most important foreign exchange rate in all economies is the underlying currency’s performance against the USD, and Zambia is no different. Since the beginning of 2025, the kwacha has appreciated immensely against the USD, in particular, 9.30% which is the largest magnitude of all. This follows the aforementioned trend of disinflation and lowering bond yields, as it signals more confidence and demand for the Zambian Kwacha. The rate also peaked in February and began the trend of appreciation during and post the first recording of disinflation in the economy as highlighted below in fig. 4 with a stable spread of around 490 to 500 pips, unlike the more variable spread and rates showing with the other tracked currencies (GBP, EUR, and ZAR).

As far as we can tell thus far, the reducing rates are a direct result of the increased confidence in the economic stability and perceived economic recovery in the nation. But how is this so?

Stagnant Risk Free Rate

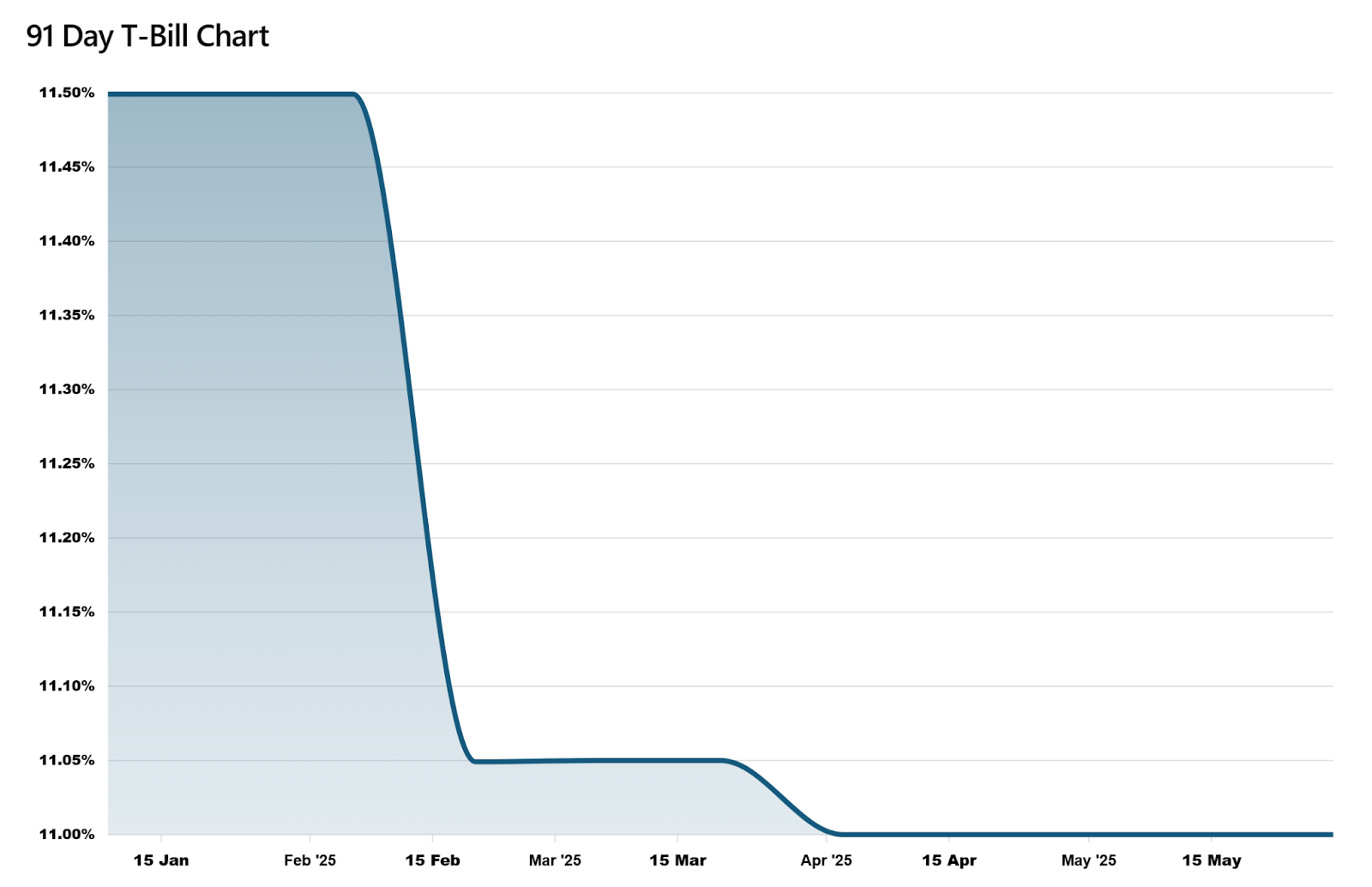

This is our first instance of divergence in the economy; YoY inflation is reducing, and government bond yields are reducing across the board, but the risk free rate is relatively the same… how peculiar. Take a look at fig. 5 for the YTD trend since the beginning of the year.

The risk free rate in Zambia has stayed between 11.50% and 11.00% flat, recording a YTD change of -0.50%. This is more modest and realistic for the timeframe, however, this is not in line with the reduced government bond rates. In normal circumstances, we would expect to see this drop at a higher magnitude in line with disinflation and the reduced bond yields, yet, the economy is in disinflation and government debt offers lower yields at the same risk level?

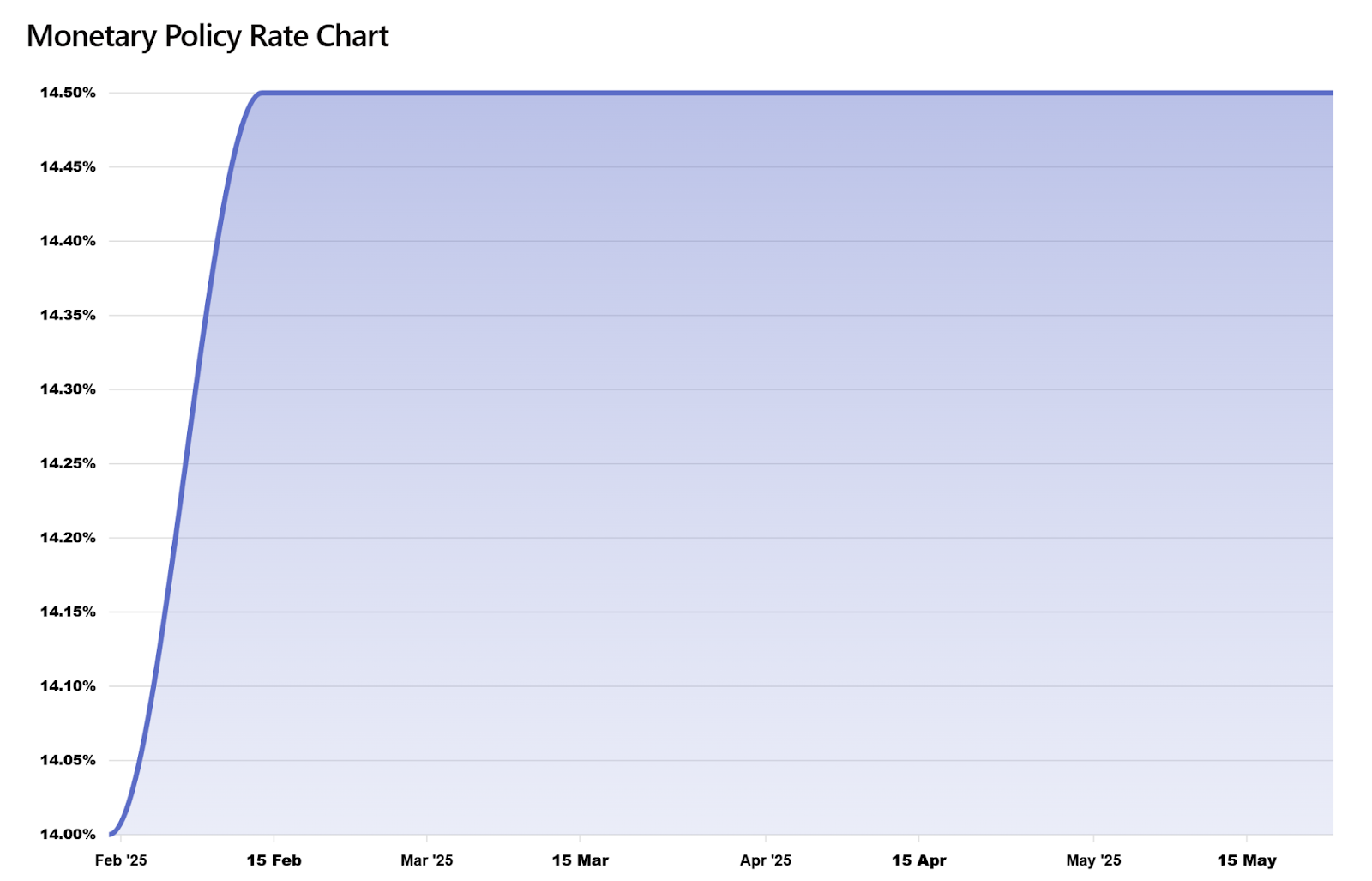

Monetary Policy Rate • No Change?

Throughout this whole “economic recovery”, Bank of Zambia has not altered their MPR to reflect the positive changes in the economy. This in and of itself is extremely superficial and directly contradicts the strengthening ZMW against the USD shown in fig. 6 below:

The economy is showing signs of recovery, yet, the cost of money has only reduced slightly relative to the other macro statistics alterations. This is illogical as a natural economy would adjust to reduce the cost of capital in economic progress to foster higher borrowing and reduce on savings to push the economy in a direction of growth. But we see the opposite occurring. The YTD MRP delta is 0.50%. This is completely abnormal, and hints at asymmetry in the country’s monetary policy strategy. How is the currency and economy stabilizing whilst there has been no change to the risk and cost of capital? This is quite curious and requires further investigation.

Lending and Deposit Rates • No Change

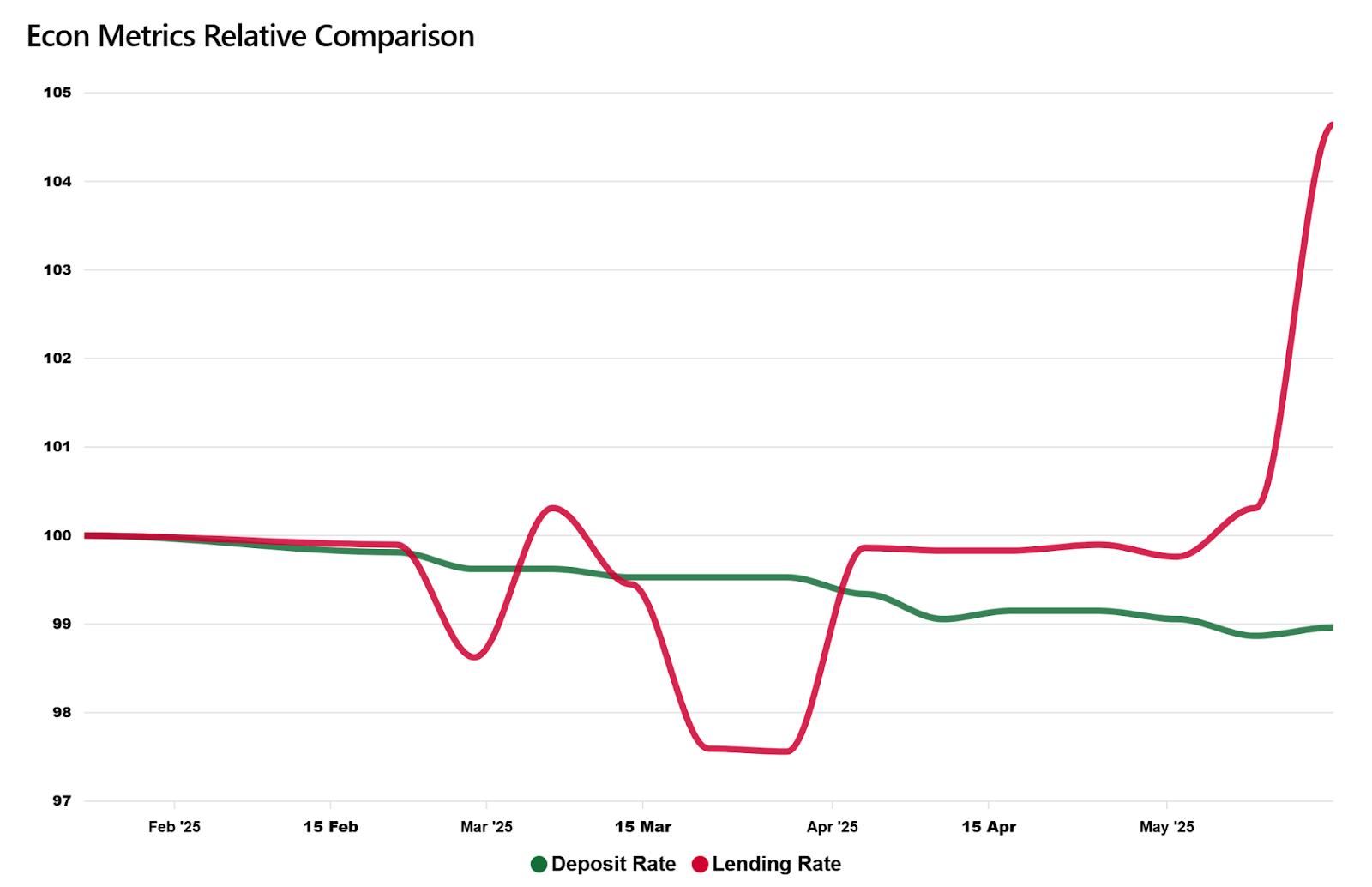

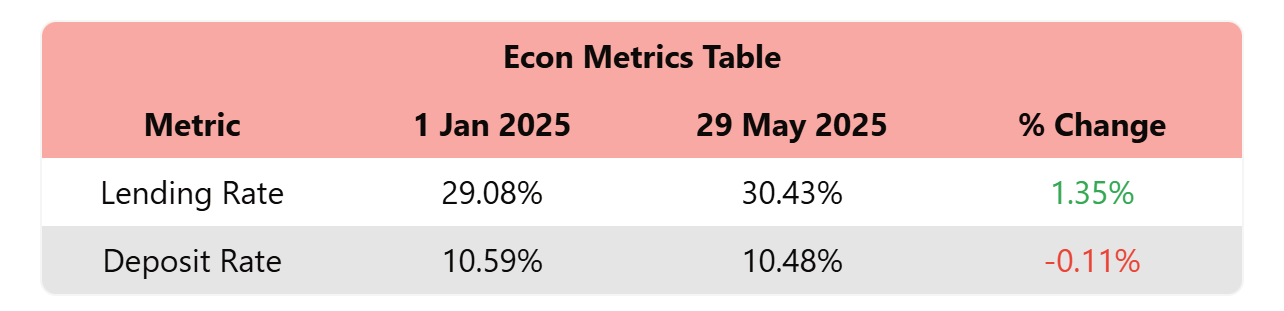

This is where the true disconnect arises, in a normal economy without hidden intervention, disinflation and perceived stability result in the cost of money reducing, and saving become more attractive. However, as we just established, the monetary policy rate rose slightly and remained stagnant, and that is the antithesis to better savings and more borrowing. When we look at the relative changes between the two rates, we see that the lending rate has only increased since the beginning of the year, and the deposit rate reduced staying within the same bounds as is illustrated in fig. 7.

As we can see, The lending rate meandered until the disinflation signal which caused it to skyrocket, and the deposit rate rose slightly before reducing post signal. This is absolutely atypical as it contradicts all prior signals; If the economy is in disinflation, bond yields are dropping, and the currency is getting stronger, these respective rates should behave in the opposite; That being the deposit rate should rise and the lending rate should drop. Therein is the proof of our axiom that the economy as it is right now is synthetic, it looks attractive from a surface level, but as we dig deeper, we realize that it is not behaving authentically. The YTD percentage changes are shown in the table below:

The deposit rate reduced disincentivizing savings staying within a small margin of 10.48% - 10.59%, whilst the lending rate increased significantly from 29.08% to 30.43% and we project this rate to only increase to roughly 32.00% over the coming months. A true anomaly in an economy, where surface level signals report recovery and strength, but realistically there is no such thing.

What Does This Mean?

This is an unnerving reality, the stock market as of now is performing extremely well only adding to the perceived growth and recovery of the Zambian economy with a YTD growth of 25.00% as of May 2025, and shattering previous milestones in record time (sitting above 19,000 points, a first ever), and the disinflation and reducing bond yields only add to the hidden underlying incongruity within the economy. This suggests that, once the hidden hand stops engineering conditions, the economy may face severe relapses with inflation rising and bond yields increasing to reflect the natural and actual risk in the economy.

Disclaimer: Observation, not advice.